The Statement

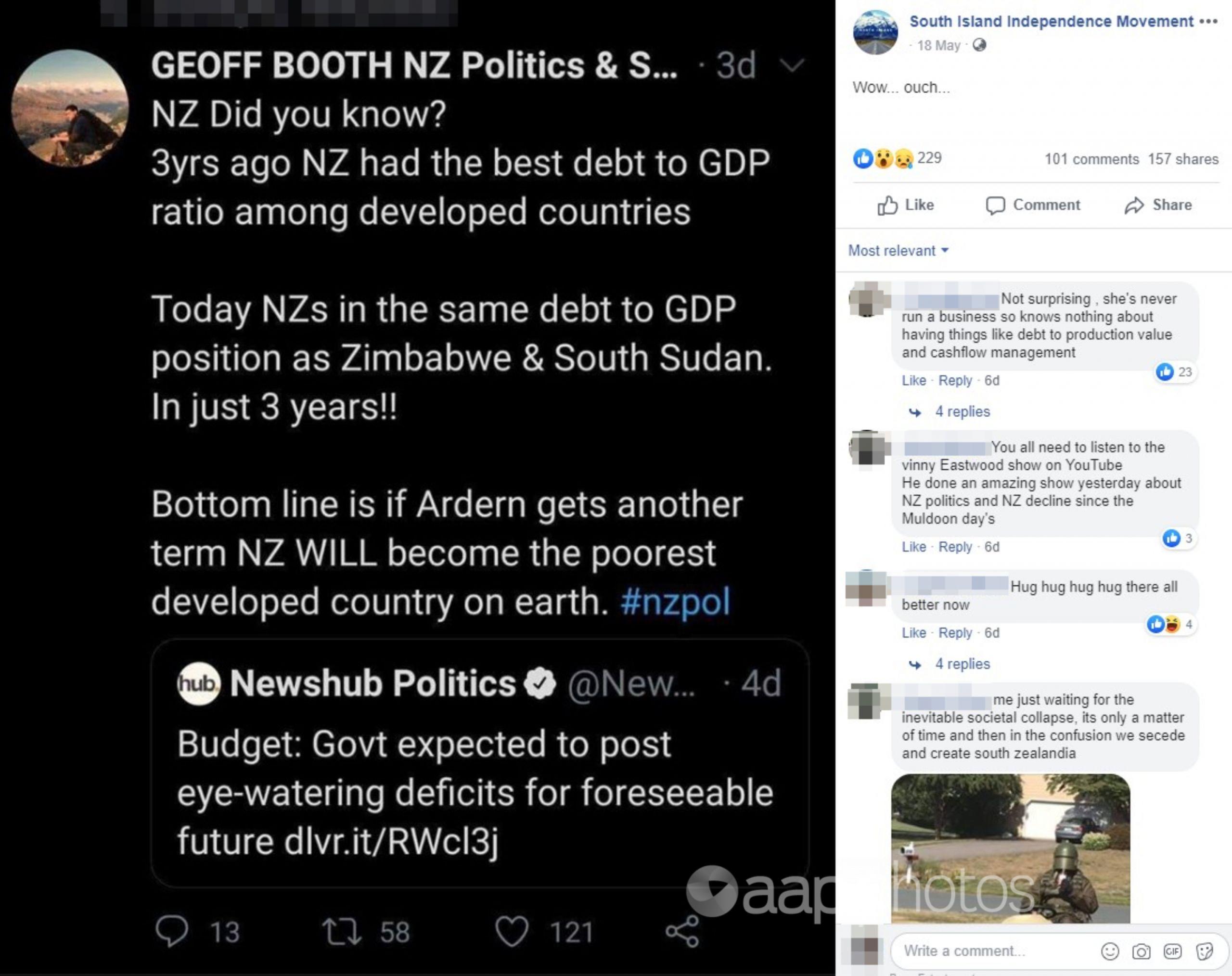

A social media post shared following the New Zealand government’s 2020 budget compares the country’s debt position unfavourably with those of Zimbabwe and South Sudan.

The Facebook post, by the South Island Independence Movement, contains a screenshot of a Twitter post. The post reads, “NZ Did you know? 3 yrs ago NZ had the best debt to GDP ratio among developed countries. Today NZs (sic) in the same debt position as Zimbabwe & South Sudan. In just 3 years!! Bottom line is if Ardern gets another term NZ WILL become the poorest developed country on earth.#nzpol”. The post is accompanied by a comment of “Wow… ouch…”.

The original Twitter post links to a Newshub Politics article headlined, “Budget: Govt expected to post eye-watering deficits for foreseeable future.”

The May 18 post has been viewed more than 21,000 times, drawn more than 220 reactions and has been shared more than 150 times.

The Analysis

Amid the COVID-19 pandemic, the New Zealand government handed down its 2020 national budget on May 14 in what Treasurer Grant Robertson described as a plan to “recover and rebuild”.

Due to the impact of the COVID-19 crisis, the government’s Budget Economic and Fiscal Update 2020 (page 28) forecasts gross debt of 33.9 per cent of GDP in 2020, compared to 27.8 per cent in 2019, with the figure reaching 58.5 per cent by 2024. NZ’s net debt is forecast to be 30.2 per cent of GDP for 2020, up from an actual net debt of 19 per cent of GDP for 2019.

Government debt can be expressed as gross or net debt. In general terms, gross debt is the total value of borrowings or debt owed by a government, while net debt is the gross debt minus the assets the government holds. New Zealand uses a measure of net debt called net core Crown debt.

The Facebook post claims that “three years ago” NZ had the best debt-to-GDP ratio among developed countries. According to International Monetary Fund figures from 2017, NZ did indeed have the lowest net debt at 4.65 per cent of GDP. NZ’s gross debt for the same year was 26.4 per cent of GDP. Comparatively, among developed countries as defined by the UN report “World Economic Situation and Prospects” (see table A page 145), the IMF figures show Luxembourg (23%), Bulgaria (23.9%) and Estonia (8.7%), all had lower gross debt percentages.

The post also claims that today NZ is in the same debt-to-GDP position as Zimbabwe and South Sudan.

In 2017, Zimbabwe’s gross debt was 78.36 per cent of GDP, according to the IMF, while South Sudan’s gross debt was 66 per cent. The IMF does not collate net debt figures for Zimbabwe and South Sudan.

The IMF, using 2018 data, projected Zimbabwe’s gross debt at 70.78 per cent of GDP for 2020.

The Zimbabwe Independent newspaper reported in January 25, 2019, that a United Nations Conference for Trade and Development report stated Zimbabwe’s gross debt-to-GDP ratio had risen to 94 per cent in 2018 and was expected to hit 117 per cent in 2020.

Concerning South Sudan, a report by the African Development Bank Group on the nation’s economic outlook for the period 2018-2021 stated: “The country is in debt distress, due to high and extra budgetary spending. Financing the fiscal deficit, primarily through loans, has reduced debt sustainability with total debt at 41.7% of GDP in March 2019.” Figures for its current debt level were difficult to determine, although the World Bank noted in its economic update on South Sudan in April that it “remains among the poorest countries in the world and four out of five South Sudanese still live below the international poverty line of $1.90 per day. Hyperinflation, high debt burden, distortions in the foreign exchange rate market, challenges in budget execution, as well as sub-national conflict further exacerbate the situation”.

The Facebook post includes a URL for a May 14 Newshub story about the 2020 budget. It includes the line: “Just a few months ago New Zealand had one of the lowest debt ratios in the world – now it’s in line with Zimbabwe and China” but does not mention South Sudan. Leading NZ economist Cameron Bagrie, of Bagrie Economics, is quoted elsewhere in the Newshub story however he told AAP FactCheck that information relating to Zimbabwe and China had not come from him.

Mr Bagrie said comparing NZ’s debt to GDP position with Zimbabwe or South Sudan was “ridiculous”.

“It’s like comparing a potato with a kiwifruit,” he told AAP FactCheck. “It’s also factually incorrect to say NZ is in the same position as Zimbabwe.”

The Verdict

Based on the evidence, AAP FactCheck found the claims in the Facebook post to be mixed, with some accurate and some inaccurate. New Zealand’s net debt-to-GDP ratio was indeed the lowest among developed countries in 2017. However on the measure of gross debt-to-GDP, NZ’s was not the lowest.

For the claim comparing NZ’s debt with those of Zimbabwe and South Sudan, NZ’s gross debt is forecast to be 33.9 per cent of GDP in 2020, with net debt at 30.2 per cent. Zimbabwe’s gross debt-to-GDP ratio was forecast to rise to 117 per cent in 2020, according to one UN-sourced report, or estimated at 70.78 per cent according to dated IMF data. Comparable figures aren’t available for South Sudan. The African nation had debt of 41.7 per cent of GDP in March 2019, according to United Nations Conference for Trade and Development report.

Partly False – The claim of the content is a mixture of accurate and inaccurate, or the primary claim is misleading or incomplete.

* AAP FactCheck is accredited by the Poynter Institute’s International Fact-Checking Network, which promotes best practice through a stringent and transparent Code of Principles. https://aap.com.au/

All information, text and images included on the AAP Websites is for personal use only and may not be re-written, copied, re-sold or re-distributed, framed, linked, shared onto social media or otherwise used whether for compensation of any kind or not, unless you have the prior written permission of AAP. For more information, please refer to our standard terms and conditions.