Myer has named former Qantas executive Olivia Wirth as its next CEO as well as announcing a drop in profit despite slightly increased same-store sales.

Ms Wirth, the former Qantas Loyalty CEO, will become Myer CEO and executive chairwoman effective June 4, a day after current chief executive and managing director John King retires, the retailer announced on Thursday.

Myer chairman Ari Mervis. who is stepping down on Thursday after five months in the role, called Ms Wirth’s appointment a new era for the company.

“Olivia is an experienced and respected leader, with a track record of delivering improved business performance,” he said

She transformed Qantas Loyalty into one of Australia’s most successful customer engagement and omni-retail businesses, Mr Mervis said, adding that since joining the Myer board last year, Ms Wirth had shown an acute understanding of the challenges facing both Myer and the broader retail sector.

Ms Wirth said she would be meeting with her team and customers in the coming weeks to understand their needs.

“My immediate priorities will be ensuring we are delivering a great in-store experience with a world-class range and best-in-class customer service, while investing in e-commerce and harnessing loyalty and partnerships among our customers and suppliers,” she said.

Ms Wirth was the other finalist to replace Alan Joyce as Qantas CEO last year but ultimately the job went to Vanessa Hudson.

Mr Mervis said he was stepping down to give Ms Wirth the best opportunity to lead the board and drive strategy.

Myer also announced Thursday that its same-store sales were up slightly in the first half and its e-commerce sales returned to growth, but its profit was down 20 per cent.

The department store chain said it had total sales of $1.83 billion in the 26 weeks to January 27, down three per cent from the same period a year ago.

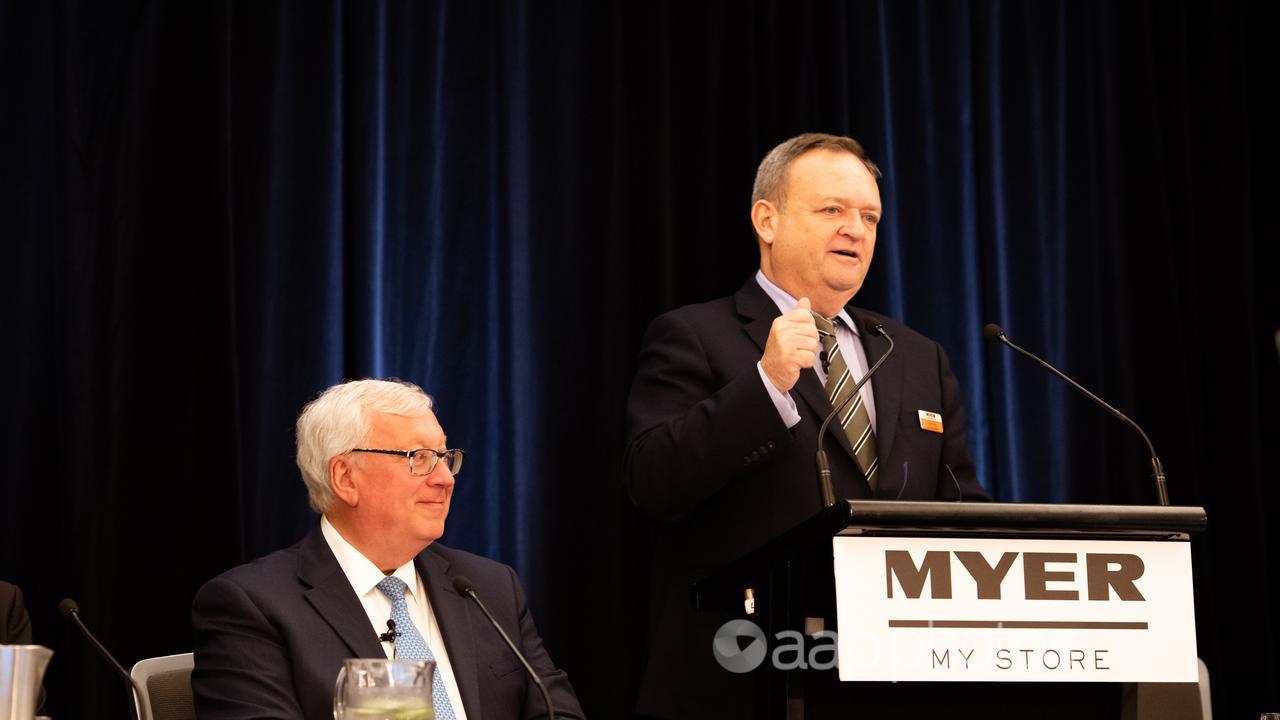

.83 billion in the 26 weeks to January 27. Image by Julian Smith/AAP PHOTOS

Myer closed its store in Brisbane’s Queens Street mall in July and on a same-store basis, sales were up 0.1 per cent.

Online sales were up two per cent to $390 million, or 21 per cent of total sales.

Its earnings before interest, tax, depreciation and amortisation was down 10.7 per cent to $215.7 million, and Myer made a net profit after tax of $52 million, down 19.9 per cent from a year ago.

“Our underlying profit result has remained robust despite the impacts from our Brisbane store closure and increased promotional cadence,” Mr King said.

Last year Myer closed its Brisbane’s Queen Street Mall store, which had been the retailer’s second largest in Australia, opening in 1988.

The retailer is now focused on its e-commerce channels and late last year opened a state-of-the-art four-hectare national distribution centre in Ravenhall, Victoria, that is handling both online orders and distribution to its 56 stores around the nation.

Mr King said the facility would enable Myer to better manage its inventory and focus on “newness” that customers are responding to.

In the first six weeks of the second half, same-store sales were up 4.9 per cent.

“Like all retailers, we continue to remain cautious about the macroeconomic environment; however, we are encouraged with our results,” Mr King said.

Late Thursday morning, Myer shares were up 5.7 per cent to 84c.