Social media users claim Canada’s government makes consumers pay “land rent” to First Nations people, saying a similar tax will be introduced in Australia if the voice to parliament is established.

This is false. The Canadian government does not have an initiative to direct funds from consumers to Indigenous groups. Experts on Indigenous relations in Canada told AAP FactCheck the claim is absurd.

The posts are spreading misinformation about the Aboriginal and Torres Strait Islander voice, claiming the proposed advisory body will lead to new charges and imposts in Australia similar to the alleged Canadian tax.

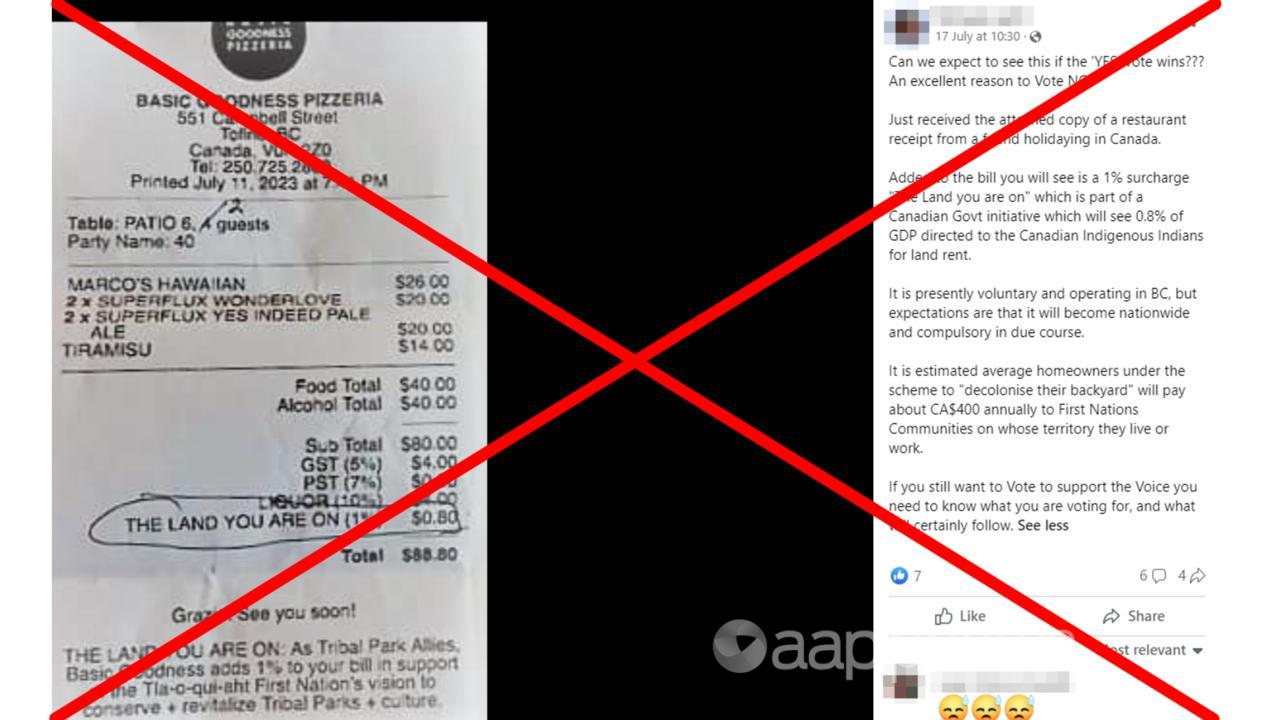

The claims are based on a photo of a pizza restaurant receipt from the Canadian province of British Columbia.

The bill from the pizzeria in Tofino includes a one per cent surcharge to support efforts to conserve and revitalise First Nations land and culture.

It’s claimed the surcharge is a government initiative to contribute a percentage of gross domestic product (GDP) as “land rent”.

“Can we expect to see this if the ‘YES’ vote wins??? An excellent reason to Vote NO. Just received the attached copy of a restaurant receipt from a friend holidaying in Canada,” one post (archived here) reads.

“Added to the bill you will see is a 1% surcharge ‘The Land you are on’ which is part of a Canadian Govt initiative which will see 0.8% of GDP directed to the Canadian Indigenous Indians for land rent.”

Other versions of the claim can be seen here, here, here, here, here, here and here.

One post reads: “The voice is based on the Canadian model. Canadians paying a Indigenous tax for simply being Canadian. If the voice gets up it will come here as well.”

But the surcharge is part of a voluntary program and unconnected to any government.

Instead, it is part of the Tribal Parks Allies program run by the Tla-o-qui-aht First Nation on the west coast of Vancouver Island in British Columbia.

Julian Hockin-Grant, co-owner of Allied Certifications, a consulting firm which works with Tla-o-qui-aht to develop the program, told AAP FactCheck the scheme was not compulsory.

“The Tribal Parks Allies program was established by Tla-o-qui-aht First Nation to achieve their Indigenous Right to benefit from economic activities in their homeland,” he said.

“This is something that is enshrined in Canadian law (see page 14) but does not exist in practice in most cases.

“Tribal Parks Allies is a voluntary program which the Tla-o-qui-aht First Nation invites businesses to participate in.

“Businesses are not required to participate, but we’re happy to report that over 125 businesses and organisations in Tofino are voluntarily participating.”

Mr Hockin-Grant said participants collected a one per cent fee from clients on behalf of Tla-o-qui-aht.

He said the program was not associated with any government.

“Revenue collected from this program has allowed the Tla-o-qui-aht First Nation to fund their Tribal Parks Guardians Stewardship Program,” he said.

“Revenue has also funded food hamper programs during the pandemic, culture practice sessions, school lunch programs, and other regional services.”

Experts also told AAP FactCheck there was no government initiative or policy where consumers paid a fee as land rent in Canada.

Associate Professor Ravi de Costa, an expert on Indigenous-settler relations at York University, said the idea Canada would impose a First Nations tax was absurd.

“I can say categorically that the federal government of Canada has no such ‘initiative’ let alone a policy mandating a form of taxation to be directed to First Nations,” Dr de Costa said.

“Nor are there any plans to introduce it. It would be constitutionally dubious and politically absurd.”

Sheryl Lightfoot, a professor at the University of British Columbia and member of the United Nations Expert Mechanism on the Rights of Indigenous Peoples, agreed.

“I can confirm that no such government initiative exists in Canada or in British Columbia,” Professor Lightfoot said.

As explained in previous AAP FactCheck debunks, Australia’s proposed constitutional amendment makes clear the voice would be a body that could make representations on matters affecting Indigenous people.

Under the amendment, there is no requirement for the parliament or executive government to follow any representations made by the voice.

The Verdict

The claim a Canadian government initiative requires consumers to pay “land rent” to First Nations is false.

Experts told AAP FactCheck no such initiative or policy exists in Canada. The claim is based on a voluntary program run by the Tla-o-qui-aht First Nation in the province of British Columbia.

False – The claim is inaccurate.

AAP FactCheck is an accredited member of the International Fact-Checking Network. To keep up with our latest fact checks, follow us on Facebook, Twitter and Instagram.

All information, text and images included on the AAP Websites is for personal use only and may not be re-written, copied, re-sold or re-distributed, framed, linked, shared onto social media or otherwise used whether for compensation of any kind or not, unless you have the prior written permission of AAP. For more information, please refer to our standard terms and conditions.