TOKYO, April 8, 2024 /PRNewswire/ — In another signal that the Japanese technology market is hotting up – Japanese Fintech leader Smartpay was oversubscribed in raising USD $7 Million in pre series A round.

The world’s 4th largest economy has seen an increase in local and foreign investment in Japanese technology companies.

Smartpay has brought together leading Japanese, European and American powerhouse investors that have deep experience in the Fintech industry.

Smartpay is leading digital embedded finance in Japan – the first in Japan to offer no interest, no late fees, and free of charge installments at the point of purchase.

It provides the only checkout process with credit card or direct from a bank account that takes less than 10 seconds and with a hassle-free fully automated installment experience so consumers no longer need to visit a convenience store for installment payments or have cash ready for delivery. Consumers can also avoid the anxiety of sharing information with unfamiliar merchants.

Smartpay launched “Smartpay Bank Direct”, Japan’s first and only digital financing service that allows customers to pay for online purchases straight from their bank accounts. This service has given Japanese consumers who prefer not to pay by credit card (which is 70% of purchase in Japan), a digital payment method that aligns to their needs and provides convenient digital financing and installments.

Smartpay is the only payment company in Japan that has signed and integrated with the 19 largest banks in Japan and over 200 credit unions thus accessible to 90% of Japan’s population with bank accounts. Smartpay Bank Direct was developed with the Japan Electronic Payments Promotion Organization (JEPPO).

Smartpay helping Japanese merchants grow ecommerce revenue:

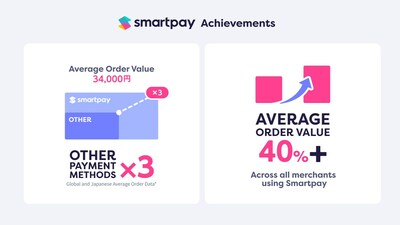

At merchants that have introduced Smartpay, Smartpay users have average order value +40% higher compared to non-Smartpay users. The average order value is USD $240, 3x higher than global peers.

Japan has one of the highest website cart abandonment rates worldwide for merchants, standing at 89%, compared to the USA’s 77%. Additionally, the conversion rate on Japanese merchant websites is just 11%, significantly lower than the 23% rate in the USA.

Smartpay helps the merchants by building a customer focused checkout process which provides them a higher conversion and lower cart abandonment rate on their ecommerce website.

The key issue affecting Japanese merchants is the complicated checkout experience for consumers, concerns about data sharing credit card details, home addresses and phone numbers with merchants they don’t know. Additionally, there are no free digital finance options available at the point of purchase.

For Japanese merchants, Smartpay takes all the fraud risk, which is critical as we transition to digital payments. It manages all fraud chargebacks, saving money, time, and resources for merchants. Smartpay’s integration process is fast, requiring only a day with its highest quality SDKs and APIs compared to the industry norm of two weeks. Apple Pay and Google Pay are automatically integrated into the Smartpay solution, saving merchants from costly integration resources. Additionally, Smartpay offers free e-commerce training for 10,000 Japanese merchants to learn e-commerce best practices in increasing website conversions, attracting new customers, and increasing the average order value for businesses.

Instore expansion launched this week:

This week Smartpay has launched Japan’s first fully digital in-store payments with free automated installments.

Smartpay has developed new technology to enable Merchants to set up Smartpay for in-store purchases with installments in 30 seconds and without any integration cost.

Merchants can integrate through Smartpay’s newly developed Merchant App QR code scanning technology or a new technology developed by Smartpay using NFC touch. Both innovations mean consumers can easily pay in three installments at the checkout without the need for a long registration process and at the same time merchants avoid potential fraudulent behavior that exists on other in-store QR code payments. Consumers can pay with credit card or direct from a bank account in-store, same as online. Smartpay aims to grow to 2 million consumers within 2 years and 30,000 merchants within 3 years.

Comment from merchant – Onward Group:

“In mid-December of last year, we introduced Smartpay to Onward Closet, the official E-Commerce site of the Onward Group, in order to provide a variety of payment methods and improve customer satisfaction. The timing of the introduction coincided with SmartWeek (Smartpay cash-back campaign), and many customers immediately took advantage of Smartpay. The average order value per customer during the month of introduction was more than 1.5 times higher than other payment methods, and we feel that we were able to fulfill our customers’ desire to buy today.” Jun Morita, Manager, Customer Success Div., Innovation Group.

Japanese leading Venture Capital:

SMBC Venture Capital – One of Japan’s most experienced technology investors, with 123 portfolio companies that have completed IPOs (since July 2010).

“We are very pleased to be investing in this round as we did last year. From before the launch of the service until now, CEO Sam and the rest of the Smartpay team have been working together day and night to improve the service at a tremendous pace. The results of their efforts are starting to bear fruit, and even though the service has only been in operation for a short period of time, Smartpay has already become a service that both businesses, including major corporations, and shoppers are very happy with. And the business continues to grow at a phenomenal pace. We hope that Smartpay will evolve into an indispensable infrastructure service for businesses and purchasers in all areas of consumption in Japan, not just online. The SMBC Group will do its utmost to support this growth.”

Junya Yasuda, General Manager, Investment Sales Department IV

Angel Bridge – A venture capital firm that invests in and supports mainly seed to early stage IT services, university-launched ventures, and deep tech startups in order to create world-class mega ventures.

“Smartpay has a strong value proposition, a talented team, and advanced technology, and has great potential to become a unicorn in the fast-growing Japanese fintech market. The management and onsite team are both highly experienced and have built a strong network in the fintech industry.” Yutaro Kasai, Managing Partner, Tomohiro Kobayashi, Senior Associate

International leading Venture Capital:

Global Founders Capital – One of Europe’s largest VC’s – early round investor in Revolut, Delivery hero , Slack and Tabby (Middle East largest digital finance company)

“We back founders who start category defining companies. We believe Smartpay is innovating payments in Japan – one of the world’s largest and most important markets. Smartpay connects consumers, merchants and banks and adds value to this ecosystem in a way never seen before in Japan.” Roel Janssen Partner

Matrix Partners: One of Silicon valleys oldest VC’s – having taken over 60 companies to IPO. Brought Afterpay to the USA. Afterpay became USA ‘s largest digital finance company and was acquired by Jack Dorsey’s Block for $29 billion.

“We’re excited to support Sam and the Smartpay team. Buy now pay later may seem simple, but the opportunity size and the complexity beneath that is massive. We believe the Smartpay team has assembled unique strengths in technology, finance, risk management, and sales to develop and own this market. Their early traction is impressive, but is just a small indication of things to come.” Matt Brown Partner

Japanese fintech getting global recognition

Smartpay, with its track record, has won the “Fastest Growing Fintech Asia 2023 Award” Global Financial Market Review, “Most Innovative Digital Financing Solution 2023 Japan ” by PAN Finance and Winner 2023 Best Investment – Harvard Business School Alumni New Venture Competition Asia Pacific 2023.

Sam Pemberton Ahmed

CEO and Founder

We are super passionate about building user experience and technology that

- Help Japanese consumer access financial solutions that will fundamentally help their lives

- Help Japanese merchants with check out solutions that increase their customers satisfaction

- Help Banks directly connect to the growth in the digital economy

- Manifest into solutions that are systemically safe and digitally transformational for consumers, merchants and banks.

“Japan is the fourth largest economy in the world. Japan is trillion dollars bigger than the Indian economy, 20% bigger than ASEAN and 4 times bigger than the Saudi economy.

The impact of COVID on consumer needs, the renewed vigor in the Japanese economy that all merchants want to capture and the newly introduced policies and regulations by the government to accelerate digital transformation means Japan is right now going through a once in a 100–year transformation.

We feel it is an honor to be part of a company that can play an important and positive role in the Japanese digital renaissance.”

Service Page URL: https://smartpay.co/

*Smartpay Enters Japan’s In-Store Payment Market – Nikkei (Nihon Keizai Shimbun), https://www.nikkei.com/article/DGXZQOUB252GG0V20C24A3000000/

*Average order value (AOV) of online stores with and without BNPL options in 2022, by revenue range, https://www.statista.com/statistics/1429471/bnpl-impact-on-e-commerce-aov/

![]() View original content to download multimedia:https://www.prnewswire.com/apac/news-releases/smbcvc-leads-investment-into-smartpay-as-part-of-the-usd-7-million-in-pre-series-a-round-from-renowned-japanese-and-foreign-investors-302109491.html

View original content to download multimedia:https://www.prnewswire.com/apac/news-releases/smbcvc-leads-investment-into-smartpay-as-part-of-the-usd-7-million-in-pre-series-a-round-from-renowned-japanese-and-foreign-investors-302109491.html

SOURCE Smartpay K.K.