An online banking screenshot claims Australia’s largest bank is plotting to remove all its ATMs, starting with Queensland in July 2025.

This is false. Commonwealth Bank (CBA) told AAP FactCheck the screenshot is fake and there are no plans to completely phase out automated teller machines (ATMs).

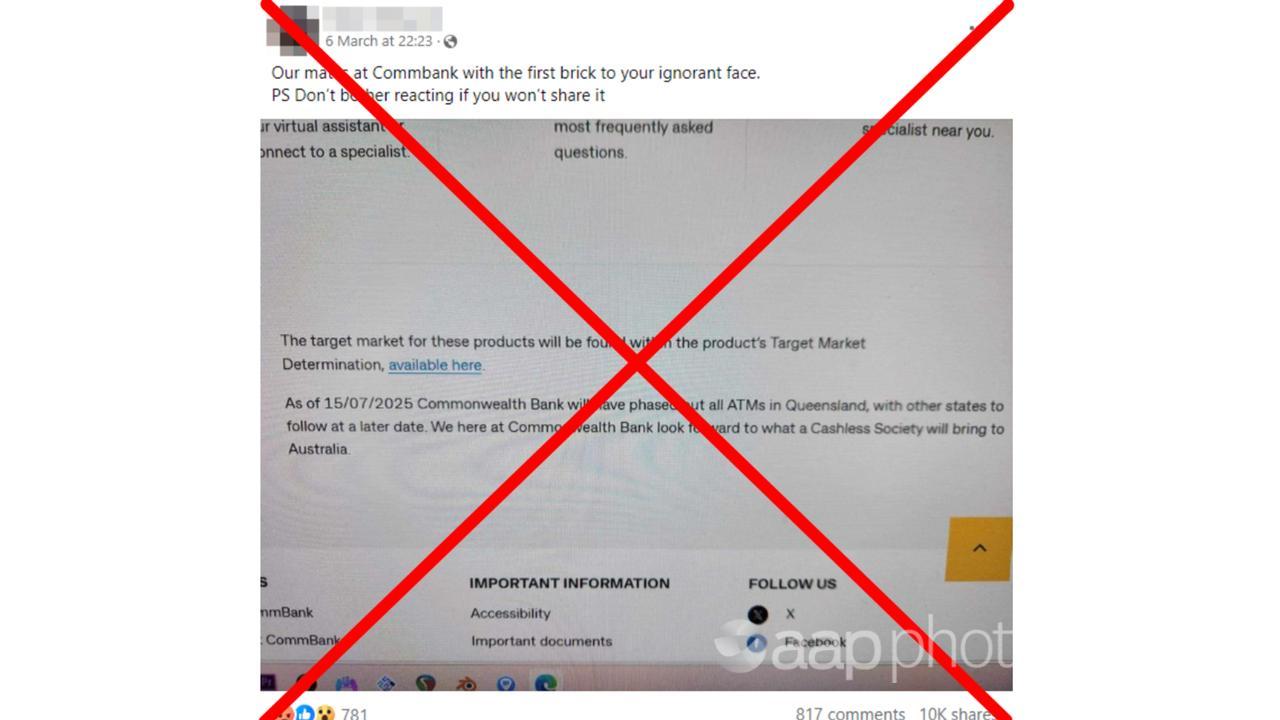

The screenshot is mocked up to look like CommBank’s website and states: “As of 15/07/2025 Commonwealth Bank will have phased out all ATMs in Queensland, with other states to follow at a later date. We here at Commonwealth Bank look forward to what a Cashless Society will bring to Australia.”

The image is being shared widely on social media and appears to have been created to fuel a cashless society conspiracy that global elites are pushing for digitial currencies in order to control people.

The screenshot and claim – as seen here and here – have gone viral on Facebook, with some posts gaining thousands of shares.

One poster comments: “Our mates at Commbank with the first brick to your ignorant face”.

Another states: “Com Bank removing all ATMs by mid 2025. What do you think about ‘cashless’ society.”

However, their fury is based on a lie – a maliciously manipulated image.

“This is a fake screenshot,” a Commonwealth Bank spokesperson told AAP FactCheck.

“While we’re investing in our digital services where the majority of customers are engaging with us, we know access to cash remains important and we certainly have no plans to phase out ATMs or stop providing cash.”

While the viral screenshot is fake, it’s true Australian banks are gradually closing branches and reducing some services.

There are concerns this will affect many Australians, particularly people in regional areas and senior citizens, and that a cashless future is inevitable.

Bankwest, a CBA subsidiary, has announced plans to close all its branches in Western Australia by the end of 2024.

Angel Zhong, an associate professor of finance at RMIT University, has written frequently about the gradual transition to a cashless society.

“The shift towards a cashless society in Australia isn’t just a possibility, it’s already well underway,” Dr Zhong told 9 News in October 2023.

In an interview with AAP FactCheck, Dr Zhong said misinformation and “sensational or alarming claims” were triggering concern among people, but the shift to digital payments was a reality.

“The use of digital wallet payments on smartphones and watches has soared from $746 million in 2018 to over $93 billion in 2022,” she said.

“Cash only accounts for 13 per cent of consumer payments in Australia as of the end of 2022, a stark contrast to 70 per cent in 2007.”

Australia’s banking regulator released statistics in October 2023 which detailed the diminishing number of bank branches and ATMs.

The Australian Prudential Regulation Authority (APRA) revealed “a further decline in bank branches in the year to 30 June 2023, with a reduction of 424 branches across Australia (11 per cent), including 122 branches (7 per cent) in regional and remote areas”.

Dr Zhong said the figures showed “718 ATMs have also disappeared” in 12 months.

“The trend does show that Australians are increasingly embracing a cashless economy,” she said.

Commonwealth Bank CEO Matt Comyn told a senate committee hearing in September 2023 that CBA was pausing all regional bank closures until the end of 2026.

“In the six years since fees were removed, the number of major bank ATMs in Australia has more than halved,” Mr Comyn told the inquiry.

The Commonwealth Bank told AAP FactCheck the bank aimed to keep much of its large network of branches and ATMs.

“We are committed to maintaining the largest branch network in the country, which is currently up to 60 per cent larger than other major banks,” the spokesperson said.

“We have also chosen to maintain the largest and most convenient bank-owned ATM network in the country – which is twice as large as our nearest major bank competitor.”

AAP FactCheck has debunked other cashless society claims here and here.

The Verdict

The claim that Commonwealth Bank has announced it will remove all automated teller machines (ATMs) in Queensland by July 2025 is false.

An image created to look like a CommBank online banking page has gone viral on social media, but the bank told AAP FactCheck the image is fake.

Australian banks are reducing the number of branches and ATMs. However, there has been no such announcement from CommBank about removing all ATMs.

False – The claim is inaccurate.

AAP FactCheck is an accredited member of the International Fact-Checking Network. To keep up with our latest fact checks, follow us on Facebook, Twitter and Instagram.

All information, text and images included on the AAP Websites is for personal use only and may not be re-written, copied, re-sold or re-distributed, framed, linked, shared onto social media or otherwise used whether for compensation of any kind or not, unless you have the prior written permission of AAP. For more information, please refer to our standard terms and conditions.