A mysterious post is spreading on social media following the deadly riots and looting in Papua New Guinea (PNG).

At the time of writing more than 23 people are dead and dozens injured following unrest in the capital Port Moresby and second-largest city Lae.

The violence broke out on Wednesday after some public servants, including the police, discovered their fortnightly pay packets were short by up to K300 (AU$120).

Police officers stood down at 10am local time and joined other workers in a demonstration at Parliament House in the capital.

Some took advantage of the lack of police on duty by taking to the streets and looting. Shops and businesses were also set on fire.

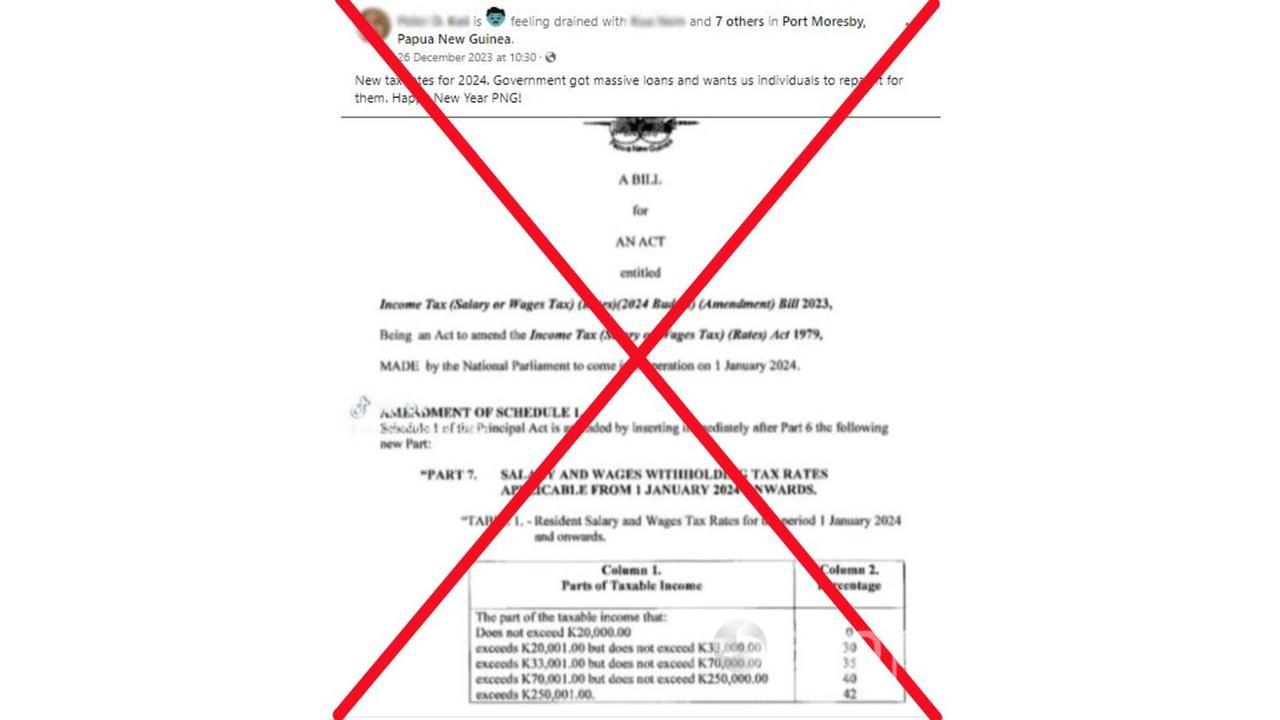

Rumours started spreading on social media (here, here and here) that the underpayment was due to the government hiking income tax rates from January 1.

Some posts (here, here and here) pointed to legislation as proof.

Prime Minister James Marape insisted that there had been no tax increase and instead the deductions were the result of a “technical glitch” concerning payroll.

He said, as set out in this statement by PNG’s Internal Revenue Commission (IRC), that the glitch had its origins in the passing of the Income Tax (2024 Budget) (Amendment) Act 2023 last year.

The Act did two things in particular. It made the temporary increase in the tax-free salary threshold, from K17,500 to K20,000, permanent. It had been due to end on December 31.

The Act also removed the dependant rebate, which provided tax concessions to PNG taxpayers with dependants who met certain criteria.

Mr Marape has said the underpayments were a result of the government’s Alesco payroll system not accounting for the extension in the K20,000 tax-free threshold. Therefore it reverted to K17,500 on January 1.

The government has said the issue has been fixed and that any money owed will be paid in the next pay cycle.

The government said the removal of the dependant rebate was also yet to be factored into the payroll system, so did not contribute to the underpayments.

Then on Friday, with police and security forces attempting to restore calm, a mysterious post appeared across social media (examples here, here, here and here).

The viral post, signed off by an “Alesco System Analyst”, claimed that the government’s explanation of a glitch was “simply a cover story”.

AAP FactCheck contacted Alesco to ask if anyone at the company was behind the post. No response had been received by the time of publication.

Regardless of who was behind the post, information contained within it is false.

Crucially, it states that the discontinuation of the dependant rebate will result in a reduction in take-home pay for those earning K20,000 and under.

Specifically, it claims their tax bill will increase by “no less than K67 per fortnight”.

This is false. As workers earning K20,000 are under the tax-free threshold, they are not taxed in the first place. Therefore they are not eligible for tax rebates. This is explained in this IRC tax calculation document from last year.

The post also claims that those earning above K490 per fortnight will see a tax deduction reflected on their payslip from January 1.

This is also false as K490 per fortnight equates to an annual salary well below the K20,000 tax-free threshold.

Dr Bal Kama, adjunct assistant professor at the University of Canberra and a PNG constitutional law expert, told AAP FactCheck by email that income tax increases can only be made through acts of parliament, which have not occurred.

Therefore the many posts (example here) stating that the government has legislated an income tax increase are false.

Posts pointing to the Income Tax (2024 Budget) (Amendment) Act 2023 legislation as proof of an income tax hike (examples here, here and here) are also false.

As outlined above, this Act concerns the increase in the K20,000 tax-free threshold and the removal of the dependant rebate. It does not include a rise in rates of income tax.

“Tax and income issues are only part of the picture behind the events that unfolded,” Dr Kama told AAP FactCheck.

“There are some deep-seated issues that were able to compel key embodiments of rule of law, the police and soldiers, to act.”

Professor Anthony Regan, a constitutional law expert at the Australian National University who has lived and worked in PNG for nearly 20 years, agreed, saying any suggestion of a reduction in income had the potential to spark anger.

“There are very low wages in PNG,” Prof Regan told AAP FactCheck.

“Those who are employed are still living hand-to-mouth and most people are unemployed.”

The Verdict

The claim Papua New Guinea residents on K20,000 a year will receive less take-home pay because the dependant tax rebates have been discontinued is false.

The rebates were only available to taxpayers, and workers earning under K20,000 do not pay tax in PNG.

It is one of several false claims in posts made in relation to the disorder in PNG. Other false claims include that the government has legislated a rise in income tax rates.

False — The claim is inaccurate.

AAP FactCheck is an accredited member of the International Fact-Checking Network. To keep up with our latest fact checks, follow us on Facebook, Twitter and Instagram.

All information, text and images included on the AAP Websites is for personal use only and may not be re-written, copied, re-sold or re-distributed, framed, linked, shared onto social media or otherwise used whether for compensation of any kind or not, unless you have the prior written permission of AAP. For more information, please refer to our standard terms and conditions.